Overview

Modern enterprises generate vast amounts of data across finance, operations, HR, and other domains. Hidden within this data are critical signals that indicate problems, opportunities, or risks. However, identifying these signals manually is like finding a needle in a haystack. Anomalies—unusual patterns that deviate from expected behavior—can indicate fraud, operational issues, market shifts, or emerging opportunities. But without systematic detection, these anomalies often go unnoticed until they've caused significant damage.

Traditional approaches to anomaly detection rely on manual review, threshold-based alerts, or simple statistical methods that generate high false positive rates. Finance teams manually review transactions for fraud, operations teams monitor dashboards for unusual metrics, and HR teams track patterns in workforce data. This manual approach is time-consuming, inconsistent, and prone to human error. Important anomalies are missed while teams waste time investigating false alarms.

Threshold-based alerting systems are also problematic. They generate alerts when metrics exceed predefined thresholds, but these thresholds are often set too high (missing important anomalies) or too low (generating excessive false positives). Additionally, threshold-based systems don't account for context—a sales spike might be normal during a promotion but anomalous otherwise. Without context, threshold alerts are either ignored (too many false positives) or miss important issues (thresholds set too high).

The challenge is that anomalies come in many forms. Some are obvious spikes or drops in metrics. Others are subtle changes in patterns, relationships, or trends. Some anomalies are isolated to a single domain (e.g., unusual financial transactions), while others span multiple domains (e.g., a correlation between HR turnover and operational quality issues). Detecting these diverse anomaly types requires sophisticated analysis that considers time series patterns, seasonality, trends, and cross-domain relationships.

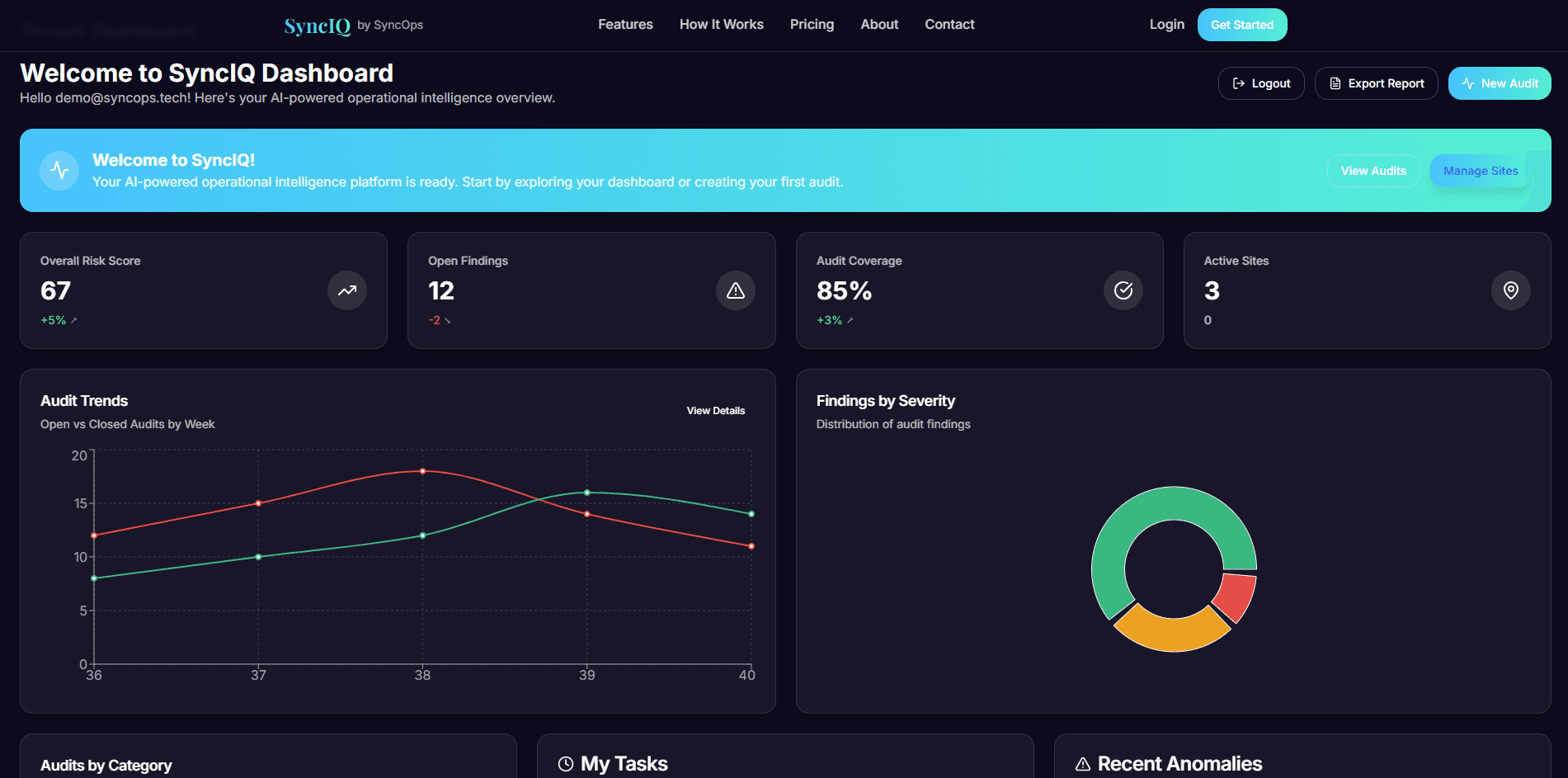

SyncIQ's Anomaly Detection for Operations addresses these challenges by using advanced analytics to systematically identify anomalies across finance, operations, and HR data. The system analyzes time series data to understand normal patterns, detect deviations, and identify unusual correlations. It considers context, seasonality, and trends to reduce false positives while ensuring that genuine anomalies are surfaced.

The system's time series analysis capabilities are particularly powerful. It learns normal patterns for each metric—daily cycles, weekly patterns, seasonal variations, and long-term trends. When actual data deviates significantly from these learned patterns, the system flags it as a potential anomaly. This approach is much more sophisticated than simple threshold-based alerting because it accounts for expected variations (like higher sales on weekends) while detecting truly unusual patterns.

Seasonality detection is crucial for accurate anomaly identification. Many business metrics have natural seasonal patterns—retail sales peak during holidays, HR hiring increases in certain months, operational efficiency varies by season. The system learns these patterns and adjusts its anomaly detection accordingly. A sales increase in December might be normal (holiday season) but anomalous in March, and the system accounts for this context.

Cross-domain correlation analysis identifies anomalies that span multiple business areas. For example, the system might detect that an increase in customer complaints correlates with a decrease in employee satisfaction scores and an increase in operational errors. This type of cross-domain insight is difficult to identify manually but can reveal root causes of business problems.

The system provides context and severity scoring for each detected anomaly. Rather than just flagging that something is unusual, it explains why it's unusual, what the potential impact might be, and suggests investigation steps. This context helps teams prioritize which anomalies to investigate and provides guidance on how to investigate them.

Recommended actions are another key feature. For each anomaly, the system suggests investigation steps, potential root causes, and remediation actions. For example, if it detects unusual financial transactions, it might suggest reviewing specific accounts, checking for fraud patterns, or investigating related operational changes. This guidance helps teams respond more effectively to detected anomalies.

By systematically identifying anomalies across finance, operations, and HR data, SyncIQ enables proactive issue detection, faster problem resolution, and better risk management. Organizations can identify fraud early, catch operational problems before they escalate, and discover opportunities that might otherwise go unnoticed.

How it works

- Analyzes time series data for unusual patterns

- Detects seasonality and trend deviations

- Identifies cross-domain correlations and anomalies

- Provides context and severity scoring

- Suggests investigation steps and actions

Benefits

- Early detection of fraud and errors

- Proactive issue identification

- Reduced false positives through context

- Faster response to critical issues

- Better risk management

Implementation/Checklist

- Configure data sources and time series

- Set up anomaly detection algorithms

- Define alert thresholds and severity levels

- Establish investigation workflows

- Train staff on anomaly interpretation

- Create escalation procedures

- Monitor and refine detection rules

FAQ

How does the system reduce false positives?

By analyzing context, seasonality, and cross-domain correlations, the system can distinguish between genuine anomalies and expected variations.

What types of anomalies can be detected?

The system can detect anomalies in financial transactions, operational metrics, HR patterns, and cross-domain relationships between these areas.